Decentralisation

You see this word everywhere in the crypto space.

Understanding this single word will go a long way toward your understanding cryptocurrencies as a whole.

Here’s what it means:

“Centralised”: 100% Control.

Banks are CENTRALISED entities that have their own system for keeping track of your FIAT currencies deposited with them.

Fiat currencies take the form of paper, plastic, polymer and metal that you either carry with you in your wallet, keep under your pillow or deposit in your bank account.

Banks have their own software and hardware in data centres (consisting of lots and lots of computer servers connected to the Internet 24/7) that they own or rent, to track and verify transactions between you and other parties.

Because the banks own, operate and maintain their own software and hardware, they have 100% control over its own system.

And every country has laws that compel banks to give your bank account transactions to the authorities if you’re being audited, or freeze your account as requested by them, without your permission at any time, if they suspect that you are doing something illegal, or in the midst of committing a crime.

Banks also need to work with Central Banks and governments to implement monetary and economic policies.

For this to work, they MUST have control over our money — for taxation, and to prevent massive outflows of funds overseas, among other things.

Now if you exchanged your fiat currencies for cryptocurrencies which operate on blockchains, the banks and the authorities can no longer track your cryptocurrency transactions, nor exert control over your money.

This is because the blockchain isn’t the banks’ system.

The banks didn’t create it, nor can they maintain it.

In fact, the blockchain system was created as an alternative to the banks’ centralised system.

A blockchain is operated and maintained by thousands, even hundreds of thousands of computers all over the world connected over the Internet, by separate entities and individuals.

They are willing to do this and spend their own money in electricity and space costs, in return for REWARDS in the form of the cryptocurrencies they are verifying and validating.

As such, the blockchain is a DECENTRALISED system because no single entity owns it.

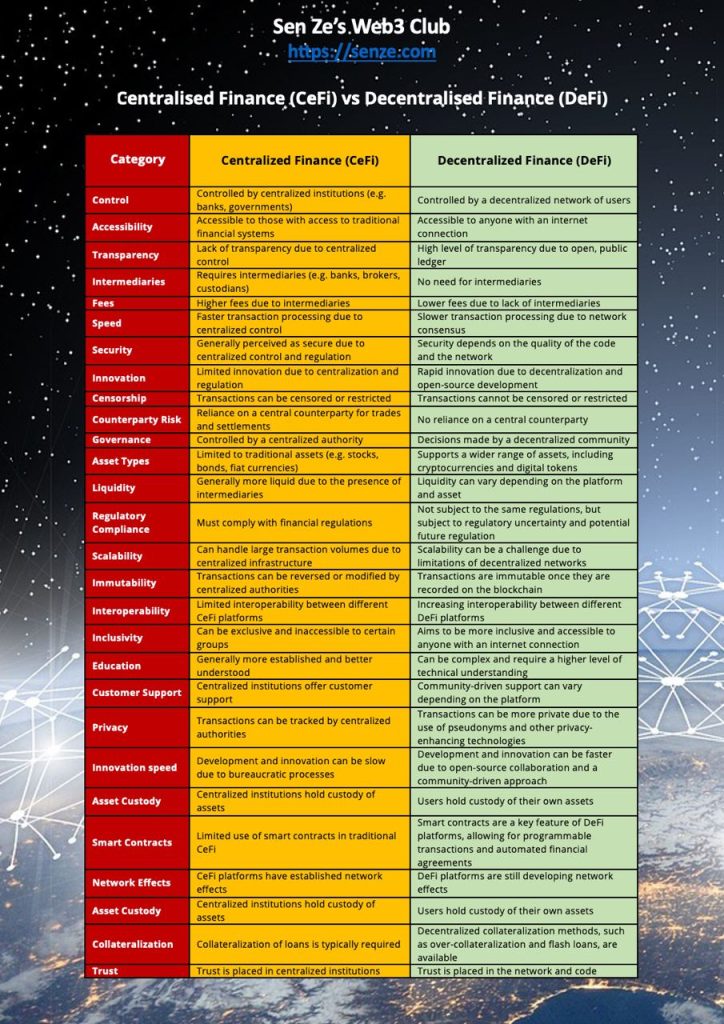

Thus “Centralised Finance” or “CeFi” means the traditional banking system as applied to fiat currencies.

And “Decentralised Finance” or “DeFi” means the blockchain system as applied to cryptocurrencies.

You can now immediately see WHY governments don’t like Decentralised Finance.

And why some of them outright ban or severely restrict the trading or usage of cryptocurrencies within their borders.

But on the other hand, the blockchain is a massive technological development in our history.

It has created and will continue to create MILLIONS and MILLIONS of new jobs.

And if a country is established as a blockchain centre, investments into blockchain technology and projects will pour in from all corners of the world.

This can only be good for a country’s economy, as those investments will be in the BILLIONS, if not TRILLIONS, of dollars.

As such countries like the following:

1. Switzerland

2. Singapore

3. Japan

4. Korea

5. The UAE

and more are fighting among themselves to be known as THE blockchain capital of the world.

And more recently, China too — through its favourite rebel Special Administrative Region (SAR), Hong Kong.

Note that China has previously banned cryptocurrency trading and mining among its citizens.

But because China itself is an economic powerhouse, and one of the leaders of technology in the world, it certainly recognises the huge benefits blockchain technology will bring to its citizens.

As such, China would be foolish to let leadership in blockchain and other Web3 technology fall to other countries.

This is why it is now allowing Hong Kong to play a big role in Web3 technology (see image 2 below).

Now put yourself in a government’s shoes.

Would you outright ban the trading or ownership of cryptocurrencies that operate on blockchains that you can’t control nor prevent?

Some countries that have done this include the following:

1. Algeria

2. Bolivia

3. Nepal

4. Bangladesh

They all made using cryptocurrency as payments between their citizens, illegal.

But they have no way to enforce this, because they don’t own nor control the blockchain, so they don’t know who is paying each other.

It’s obvious those who are sitting in the government offices in the above countries have NO IDEA how cryptos and the blockchain work.

Or if they do know, they’re hoping their “laws” punishing anyone who ignores them, will work.

They won’t work.

Crypto users KNOW this.

Those laws are useless.

Or would you take the middle ground and allow the activities, but pass laws to regulate the industry as far as you can regulate it?

To me, and likely you, the answer is obvious.

And now that you know, you’ll see the crypto and/or blockchain industry very differently moving forward.

Cryptos are not only here to stay, they will become more and more important with every passing day.

See attached image No.1 for the differences between CeFi and DeFi for a deeper understanding of these 2 competing concepts. They’re important, so take your time to really go through all the points seen.