Working Vs “Not Working” Part 2

You now know how bitcoin mining works. Because of the estimated 1 million miners in the world (computers that perform the calculations to validate bitcoin transactions every second of every minute of every hour of every day) — bitcoin mining takes up a LOT of energy in the form of electricity.

The amount of electricity consumed just for bitcoin mining alone is estimated to be 127 terawatt-hours (TWh) a year. This is more than what many countries consume in the same period — just to validate transactions!

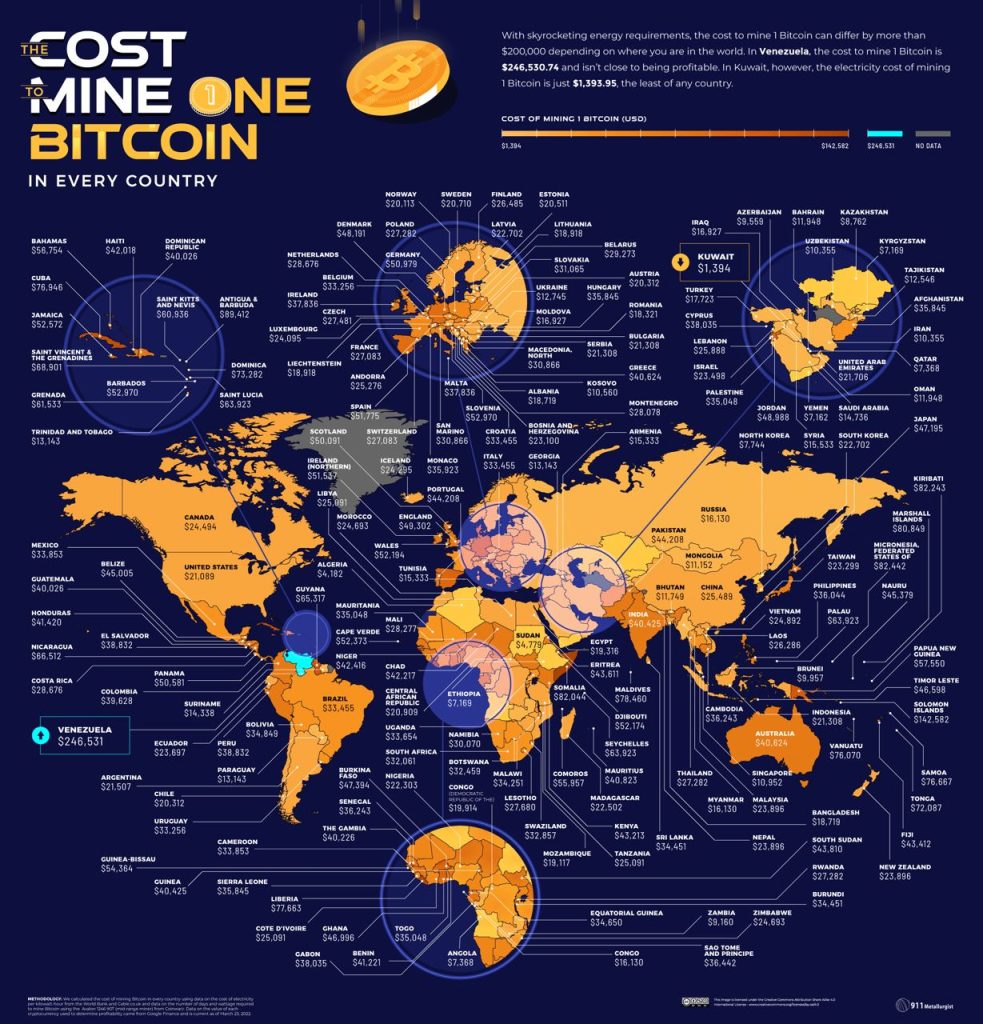

Depending on where the bitcoin miner is located, the cost of electricity can be either very high, or very low. With the current bitcoin price at USD26k each, a miner needs to spend less than this amount on electricity to be profitable.

But look at the graphic below. The most expensive country to mine bitcoin is Venezuela, where it costs a whopping USD246,530.74 just to mine one bitcoin. The least expensive country is Kuwait, where it costs just USD1,393.95.

Note that the time it takes for a successful validation of a block of bitcoin transactions by any single miner is about 10 minutes.

But any single miner will take about 30 days to successfully mine one bitcoin, as it is in competition with 1 million other miners at any one time, so it will not be successful the vast majority of the time.

Thus the more miners you have running, the higher the chances of one of your miners winning the race to validate a bitcoin block of transactions, and earn the 3.125 bitcoins (starting in April 2024) as your reward.

For the reasons above, there are some huge opposition to bitcoin mining, like in Bangladesh, China, Egypt, Iraq, Qatar and others.

And some of those in crypto have also thought of solving this problem.

To do this, they went back to the very core of what mining is:

1. Miners have to put in some capital for electricity to keep operating.

2. The more miners they have (computers that validate the block of transactions), the higher their chances of winning the race to validate the transactions.

3. It’s like a lottery where the more capital you put in (by paying for electricity), the higher the chances of winning the prize (the mining rewards) — like the more lottery tickets you buy, the higher your chances of winning the jackpot.

And so…

Why not do away with mining using computers that consume huge amounts of electrify, and just get people who are interested in validating crypto transactions to keep adding to the blockchain, to just lock up some capital in the crypto network they want to act as validators (or miners) for?

Their “miners” (computers) don’t have to solve any mathematical puzzle like bitcoin, but are assigned the winner by chance.

The algorithm for choosing a winner will take into account how much capital has been locked up in the crypto network by which validator. The higher the capital allocation by a single validator, the higher his chances of winning the reward as a successful validator.

The end result?

Exactly the same as bitcoin mining.

But without any need to consume huge amounts of electricity.

This simple solution cuts down on the electricity consumption by more 99.9%!

This method of validating blocks of crypto transactions is called “Proof Of Stake”.

“Stake”, because miners are staking their capital (like a gambler would stake his money on a bet) for a share of the rewards if they are successful in being chosen to verify the next block of transactions.

Ethereum started as a Proof Of Work crypto just like bitcoin, in 2015. It then transitioned to the Proof Of Stake method for the reasons above, in 2022.

“Proof Of Stake” is the “Not Working” method in the title of this post.

To keep the Proof Of Stake validator honest, there is a minimum capital required to be locked up in the crypto network.

In addition, the time this capital is locked up can vary from days to weeks to months.

Thus if anything improper from the validator is detected by the network, the validator loses his capital — so he is incentivised to act honestly.

In the Ethereum network, the minimum stake is 32ETH, or more than USD50,000.

You can however pool together with other stakers if you have less than this amount, to make up this amount. In this case you’ll have to trust third parties to organise this pool, which comes with its own risks.

How much can a staker earn?

It depends on the crypto, and whether you believe the crypto itself will appreciate in value over time.

There’s no use earning rewards in the crypto you’re staking, if the crypto itself does not appreciate over time. If you’re doing it for the short term and you believe it will increase in price in that short time but not in the longer term, you’ll immediately sell it for USDT or any stable coin so that you won’t have to suffer the effects of depreciation if any.

But of course, you won’t be enjoying the effects of appreciation either, if it happens.

While ETH would appear to be quite a solid coin to consider staking as it is usually tied to bitcoin’s performance, and we expect bitcoin to increase in price due to its halving events every 4 years — nothing is set in stone, and it’s still a risk that we take.

If you’re staking to earn from its rewards alone without taking into account its appreciation in that you expect the price of the crypto to remain the same, the rewards may not be enough to make it worth your while.

That said, staking is as passive as passive can be. It’s like putting your paper money in an FD/CD in a bank, and earning interest on it.

But with staking you have depreciation risk that is higher than your paper money — and an appreciation benefit that is also higher. It depends on what you want.

Me? I prefer to trade cryptos automatically, and earn profits of between 0.3% – 1.0% a day or higher (or 9% – 30% or higher a month), using my 9th Wonder Of The World system.

These earnings are in USDT, so I know what their value will be whenever I earn them.

So I have never staked, nor do I plan to, as I’m getting a much higher return without doing it.

In addition, if I really want the benefit and certainty of returns that is likely higher than staking, I can simply lend out my USDT via one of the “crypto banks” like NEXO that I covered earlier.

I can earn between 12% – 16% a year just putting my USDT in my own wallet in my account in NEXO.com.

USDT is a stablecoin, so I know what my earnings at the end of the lending period will be, as USDT will neither appreciate nor depreciate in terms of the USD it represents, unlike the cryptos.

Of course, NEXO is centralised, unlike blockchain networks which are decentralised — so NEXO is more vulnerable to hacking and the such.

There are risks in everything, so it’s up to you to assess your own comfort levels and what you really want.