CeFi (Centralised Finance) vs DeFi (Decentralised Finance)

CeFi or Centralised Finance is the traditional financial system where financial activities are controlled by centralized authorities or intermediaries, such as banks or financial institutions.

In CeFi, transactions, custody of assets, and decision-making are typically managed by trusted third parties, and compliance with regulatory frameworks is enforced.

In DeFi or Decentralized Finance, financial activities are conducted in a decentralized manner using blockchain technology. DeFi eliminates intermediaries and provides open, transparent, and permissionless access to financial services.

DeFi uses smart contracts and decentralized protocols (“protocols” = “rules”) to enable peer-to-peer transactions, asset management, lending, borrowing, and other financial activities, allowing individuals to maintain control over their assets and participate in governance decisions.

To further understand the above, you need to know the meaning of some of the terms used.

1. “Permissionless Access”

In CeFi systems, accessing certain financial services often requires meeting specific criteria, such as having a bank account, meeting Know Your Customer (KYC) requirements, or being a part of a specific jurisdiction. These systems are built around a centralized authority that controls access and sets the rules.

On the other hand, DeFi platforms are designed to be permissionless, meaning that anyone with an internet connection and a compatible wallet can access and use the services offered.

There are no gatekeepers or intermediaries who decide whether someone can participate.

This open access enables individuals from all around the world, regardless of their background or location, to engage in activities such as lending, borrowing, trading, and earning interest.

2. “Peer-To-Peer”

Peer-to-peer (P2P) transactions are direct transactions between two parties without the need for intermediaries or centralized authorities.

In a P2P transaction, the parties involved interact directly with each other, exchanging goods, services, or assets without relying on a third party to facilitate the transaction or validate the authenticity of the transaction.

P2P transactions are typically facilitated by technology platforms that connect individuals or entities seeking to engage in transactions.

These platforms provide the necessary infrastructure for participants to communicate, negotiate terms, and execute transactions securely.

Examples of P2P transactions include individuals buying and selling goods directly to each other through online marketplaces, users exchanging digital assets directly with one another, or individuals lending money to each other without involving traditional banks.

P2P transactions are often associated with decentralization and can offer benefits such as reduced costs, increased efficiency, and enhanced privacy.

Blockchain technology and DeFi platforms have further enabled P2P transactions by providing trustless and transparent mechanisms for verifying and recording transactions without relying on centralized intermediaries.

3. “Trustless Mechanisms”

The use of technology and protocols that enable participants to engage in transactions or interactions without relying on trust in a centralized authority or intermediary is a trustless mechanism.

In a trustless system, parties can transact and interact with each other directly, securely, and transparently, without the need to trust one another.

In the context of blockchain-based systems, such as DeFi, trustless mechanisms are made possible through the use of cryptographic algorithms and smart contracts.

These mechanisms ensure that transactions and actions are executed automatically based on pre-defined rules and protocols, removing the need for a trusted third party to validate or facilitate the process.

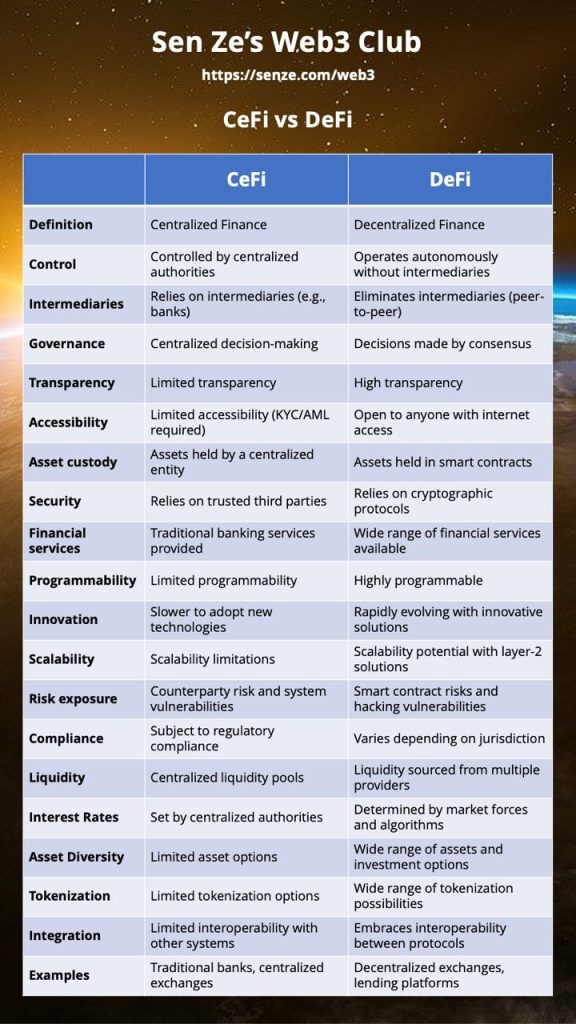

4. CeFi vs DeFi Table

See the attached table showing you more differences between CeFi and DeFi systems.

Once you understand their differences, you will appreciate better just how revolutionary the blockchain innovation is, which has spawned multiple opportunities for us to create or multiply our wealth in ways that have never existed before.